Inside the Pack: Should You Use Baseball Cards as an Investment Tool?

I recently ran across an interesting topic of conversation on an online collecting forum I participate in. The original poster more or less wanted to know about vintage cards as an investment tool. Specifically, he had read several articles about how baseball cards had outperformed major stock indices over the past few years, and he was looking for advice on how to get in. He wondered if the card market would yield a return greater than the 7% or so he was currently seeing through more traditional investments.

I shuddered when I read the topic, and was quite relieved when I saw the number of individuals who pushed back at the idea that he could see a large return from vintage cards. But the more I read, the more disheartened I became: it seemed that the primary issue these folks raised was that they felt the vintage card market was at or nearing its peak, and instead felt that key modern cards were the places to run up a return on investment. This troubled me enough that I felt it necessary to discuss investing in cards as a topic this week.

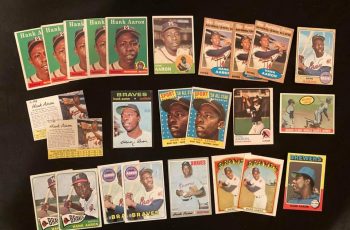

First, let’s start by acknowledging the truth — key vintage cards have seen a remarkable increase over the past few years. The important word here is “key.” While we can attempt to identify the next card that will be desired by collectors, we can never be totally sure. The past few years have seen tremendous spikes in value for the T206 Ty Cobb green portrait and the 1952 Topps Mickey Mantle, sure, but Babe Ruth strip cards and 1953 Topps Satchel Paige cards haven’t changed at the same pace. Sometimes there isn’t a rhyme or reason to these things; often the mob mentality sneaks in, and when a few collectors start to gobble up specific cards, other collectors start to follow suit.

Next, let’s address the peril in collecting solely for investment purposes. This is what we saw in this industry in the 1980s and 1990s. It leads to a bunch of people who don’t care about the hobby jacking up prices to extract profit from their investment, effectively pushing low-end collectors and kids out of the hobby. This model is only sustainable in the short term, as eventually everyone who wants a certain card will have the card, and jaded investors will start to dump inventory, sending prices downward. This doesn’t happen if you collect what you like to collect. Collecting for love of the hobby will generally have a side effect of appreciating values over the years, but if values depreciate, you aren’t stuck with “inventory” you need to move in order to recoup some seed money — you have objects you like and appreciate that are worth a little less than you paid. No big deal.

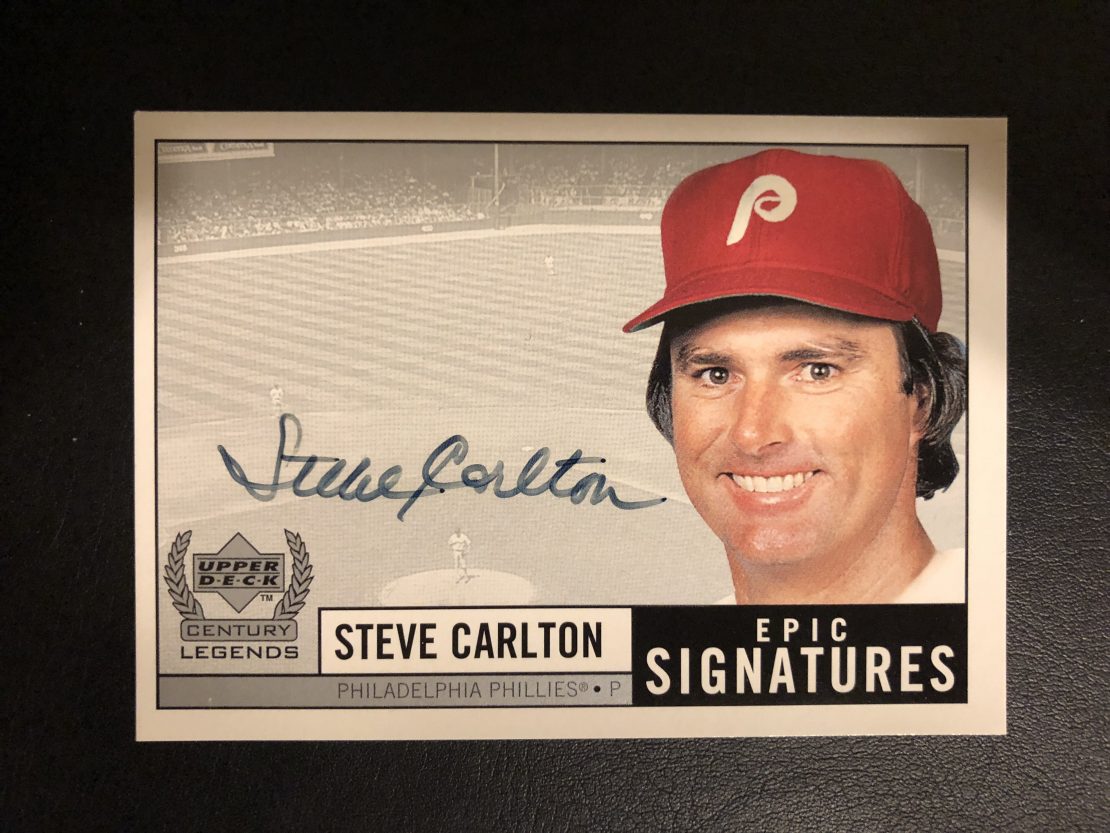

Finally, the important piece — if you ARE going to invest, modern cards are the most volatile and offer the highest risk/reward scenario. It is absolutely the case that there is more potential for modern cards to increase in value over a shorter period of time, but there is a much greater potential for a huge decrease as well. If you’re a gambler, you certainly can’t beat modern cards; if you’re looking for a solid investment, stay away. Mike Trout could break his arm or get suspended for steroids or be arrested tomorrow; Mickey Mantle couldn’t. In the event you decide to buy cards as an investment, I highly suggest going the vintage route to take the steady increase in price without the potential for a disastrous drop in value.

All this is to say, it’s certainly possible to get a nice return on investment with baseball cards. Any investment comes with a risk of losing money. But with cards, the risk is a little higher, and unlike stocks or funds, you accumulate inventory in your possession. My suggestion: collect baseball cards if you like them, and if you make money, it’s an added bonus. Collecting just to turn a profit could go wrong, and sour you on the entire hobby along with losing you money.