Inside the Pack: The Run on Retail

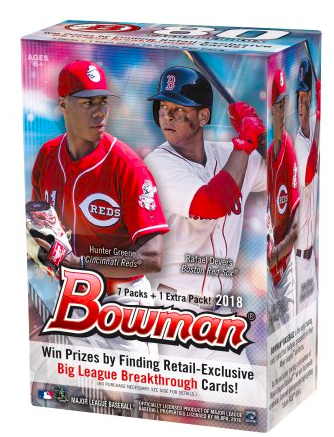

Every year since 1998, I’ve bought a box of Bowman baseball when it releases. It’s a day I look forward to for months. If the release of flagship Topps signifies the beginning of the baseball season, then Bowman’s release signifies the beginning of prospect season. Each year, I bust open packs, pore over names and stats, sell some cards, and put others away for the future. Sure, for every Aaron Judge and Kris Bryant there’s a Chin-Feng Chen or a Donavan Tate, but nothing is more enjoyable to me than letting prospect cards age for a few years in a cardboard box.

As I got older, that one box of Bowman became one jumbo box…then two jumbo boxes…then four jumbo boxes. And a few years ago, I started buying a case of jumbo boxes every year. I’d take the day off work and flip through thousands of cards depicting teenagers and recent college graduates, and it was one of the best days of the year.

Until this year. This year, I didn’t buy a single box of Bowman. I couldn’t afford it.

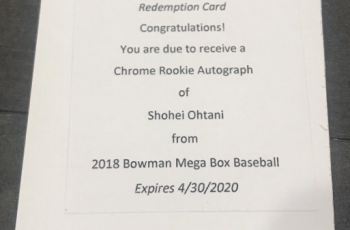

Last year, Aaron Judge’s presence in the product after a hot start to his record-breaking rookie season caused prices to jump almost 25% over what I had been paying for a case of jumbo boxes. This year, with the inclusion of Japanese superstar Shohei Ohtani, the price for a case of jumbo boxes was double last year’s already-inflated price. So I did what any rational person would do: I found a loophole.

Wanting to open my favorite product but also wanting to maintain financial stability, I decided to take a pass on jumbo boxes, and even a pass at the regular hobby boxes (which were more expensive than jumbos have been in years past). Instead, I turned to retail product. It turns out I was not alone.

I ordered blaster boxes and retail packs online, but websites like Walmart and Target were sold out within minutes of the listing going live. When they would restock, the product would sell out in minutes once again. The price of blaster boxes on the secondary market went up almost 40% over the sticker price on release day.

Around the internet, collectors shared that they were doing the same thing. For $320, you could maybe buy a single jumbo box of Bowman – or, you could buy a case of 16 blaster boxes. As we all know, retail products have tougher odds to pull certain cards, and other inserts are omitted altogether. But, there are also retail-exclusive inserts in Bowman, furthering the interest in blasters and hanger packs. And if you’re someone like me, who opens Bowman mostly for the fun of setting base cards aside for a few years, the lower odds don’t matter much. There have, thus far, been some tremendous hits out of retail – and plenty of stinkers, too. So, all in all, the luck doesn’t seem much different from opening the much-more-expensive hobby or jumbo boxes.

This phenomenon doesn’t seem to be unique to Bowman this year. Topps Heritage, which also featured an Ohtani card, was virtually nonexistent at Targets and Walmarts around the country, being cleared out by the first collector who spotted the product. Only now, more than a month after its release, have retail products been spotted again in the wild.

It’s possible the run on retail products could be a trend going forward if Topps continues to allocate its products, which inflates its price on the secondary market. Meanwhile, blaster box prices have not increased in what seems like forever – while there were $9.99 blasters in the 90s, the better products were always the same $19.99 they are now. And, with the increasing presence of retail-only inserts (and sometimes, like Topps Archives 65th Anniversary or Bowman Platinum, entire retail-only products), Topps continues to drive more customers to retail. While I like the options this offers collectors, it does give me cause for concern about brick and mortar hobby stores, which are the backbone of this industry. I hope that Topps is able to find a healthy balance between giving customers choices and feeding its hobby stores with high-quality offerings.