Inside the Pack: Interview with Collectable CEO Ezra Levine

If you’ve ever wanted to own an expensive sports card but can’t afford the whole thing, fractional investment is for you. Fractional investment in sports cards has become a hot topic over the past year or so. It allows investors and collectors alike to purchase shares of a card, much like the stock market. While many such platforms now exist, Collectable was the first site dedicated to fractional investment of only sports cards, unlike other platforms that also include vehicles, comic books, artwork, and so on. Their emergence in the industry has not gone unnoticed, as in the past month they’ve received several buyout offers on assets they offered for many times the initial public offering, or IPO, price.

Collectable CEO Ezra Levine was kind enough to answer some questions about the platform, buyout offers, and their newly-launched secondary marketplace.

———-

Inside the Pack: Tell us a little about Collectable and what makes it unique in the marketplace.

Ezra Levine: Collectable is the #1 all sports fractional ownership platform on the marketplace. Our mission is to democratize and modernize the high end sports collectibles market, making it more affordable, liquid, transparent, and fun.

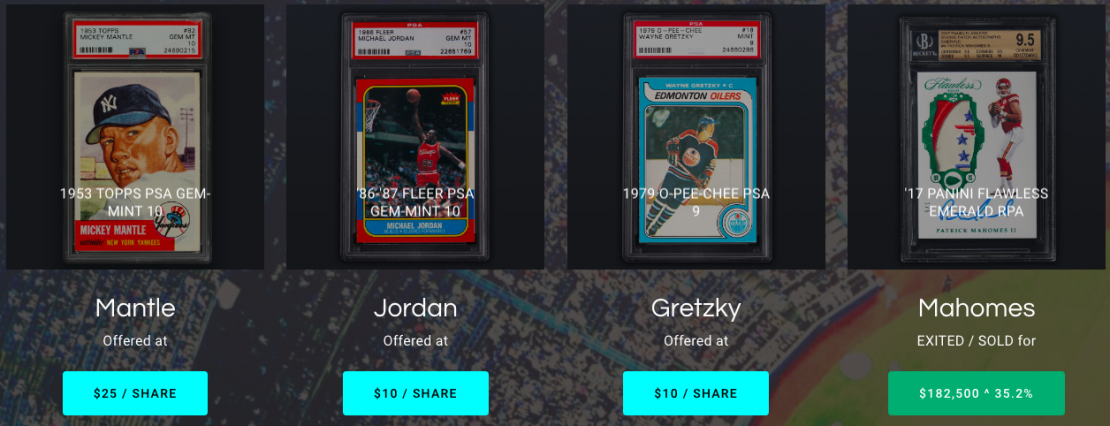

Collectable sources iconic, rare, and historically and culturally significant mementos, creates mini companies out of them via securitization with the SEC, and then offers shares of these items to the public. The result: instead of needing $2,500,000 to buy a Mantle ‘53 PSA 10, now you just need $25 to buy 1 share of the asset. Collectable makes it possible for anyone over the age of 18 in the United States (soon all across the world) to own some of the greatest items in sports. Pretty cool stuff.

In addition, Collectable has brought some much needed innovation to the collectibles space. We are the first and only company to offer “retained ownership” of collectibles. Consignors can sell partial stakes in their items to the public through Collectable, while keeping upside in case of further price appreciation. Furthermore, Collectable will be the first collectibles company to offer a continuous, “intraday” trading component beginning THIS Tuesday, February 9th from 3-4pm EST.

Inside the Pack: How does Collectable determine what assets to offer shares of? How are the items acquired — is it Collectable reaching out to private owners, or the company bidding on items in the open marketplace, or is Collectable approached by owners of items they’d like to sell?

Ezra Levine: Collectable has a large network of supply sources, including auction houses, dealers, collectors, professional athletes, agencies, museums, and institutions. Collectable is primarily a high end consignor. The vast majority of our offerings are consignments, not acquisitions. While we CAN bid on items in the open marketplace, we seldom have had the need to.

Consignors love the combination of seller flexibility we provide through retained ownership and no sellers fees along with the content we create to support their offering and the care and personal attention they receive when consigning to Collectable.

As of today’s writing, we have completed ~35 offerings since September with another 60 or so for which we’re waiting SEC qualification. Once approved, we’ll be running at least 5 IPO’s a week for the next few months. Should be fun.

Inside the Pack: As fractional investing and fractional ownership of sports cards have grown in popularity, are you seeing more non-collectors and folks who are more traditional investors come into the space and invest in sports cards?

Ezra Levine: Absolutely. This can’t be understated. There are tens of trillions of dollars being passively allocated to sectors that are currently producing low returns. This has created a search for yield in alternatives, including sports cards and memorabilia. Many institutions, including global asset allocators, are dipping their toes in the sports collectibles category – many for the first time. Should this trend continue, it will have a further dramatic impact on prices seen in the market.

In addition, the sports collectibles category has seen a huge increase in popularity as a result of key media outlets, personalities, and celebrities getting involved in the category. Recently, Barstool Sports, The Ringer, The Boardroom, The Athletic etc have begun covering the space. Athletes like LeBron James are responding on social media to record setting prices saying they, too, own sports cards. Add in Gary Vaynerchuk, Steve Aoki, DJ Skee, Mark Wahlberg and others. Sports cards and collectibles are officially cool again, and now looked at as a legitimate three headed monster with fantasy sports and sports gambling.

Exciting time to be part of the hobby.

Inside the Pack: In October 2020, Collectable offered an IPO of a 1986 Fleer Michael Jordan PSA 10 at a valuation of $100,000. A few months later in January 2021, the company received a buyout offer of $265,000. Walk us through that process. Was the company approached by a private collector to make the sale? How surprised were you by the rise in value? Did you think the shareholders would accept the deal, and how surprised were you when they didn’t by a pretty resounding margin?

Inside the Pack: In October 2020, Collectable offered an IPO of a 1986 Fleer Michael Jordan PSA 10 at a valuation of $100,000. A few months later in January 2021, the company received a buyout offer of $265,000. Walk us through that process. Was the company approached by a private collector to make the sale? How surprised were you by the rise in value? Did you think the shareholders would accept the deal, and how surprised were you when they didn’t by a pretty resounding margin?

Ezra Levine: At the time we announced the $265,000 buyout offer, this was a record price for the ‘86 Fleer Jordan 10. Fast forward just ONE WEEK and 10’s sold at Goldin Auctions for $738,000! That goes to show how rapidly the market is moving today as a result of the financial and cultural trends mentioned above converging onto the hobby at once.

Regarding the process, yes, we were approached by a private collector looking to add the card to their PC. When an offer is received, we take a 48-hour pro rata shareholder vote to assess shareholder sentiment. Each shareholders vote counts directly proportional to the percentage ownership in the asset they hold.

It’s always tempting to lock in 165% profits in a matter of months, but our shareholders were astute here. I believe fractional ownership shareholder bases will be looked at as the “smart money” in short order. The collective wisdom of crowds has proven to be efficient and accurate over time in public financial markets, Vegas sportsbooks, etc. Hundreds of opinions aggregated together via Collectable will give the marketplace an intelligent gauge of true asset values.

Inside the Pack: Conversely, a Bird/Erving/Johnson PSA 10 rookie had an IPO in October for $352,000, received a private buyout offer for $720,000, and was accepted by the shareholders. Did you think it would go down the same path as the Jordan and be voted down by shareholders?

Ezra Levine: The Magic/Erving/Johnson PSA 10 card is different compared to the Jordan because of its illiquidity. There are only 24 PSA 10’s compared to 314 Jordan PSA 10’s, and they don’t trade often.

I’ll never forget the scrutiny Collectable faced when we IPO’d this card for $352,000 back in October 2020. Many believed it was overpriced. The last public comp was in 2018 for roughly ⅓ of the price. However, we do our homework on every offering. We knew where the private market was. Ultimately we were able to generate a 100+% return for our shareholders in just a few months.

Collectable’s role is to be the caretaker and manager of assets for our shareholders, but the assets belong to the shareholders. We have a duty to present all accretive offers to them and see where it shakes out!

Inside the Pack: How much resistance do you experience from traditional card collectors who don’t understand the concept of fractional ownership?

Ezra Levine: The hobby has a poor track record of embracing new entrants and new technologies. Think back to the early 1990s with the grading companies. Many believed they were a flash in the pan. Now, they are a bedrock of the hobby and have instilled a great deal of confidence and transactability into the hobby. Same with breaking culture more recently. Breaking has brought tremendous excitement and new participants to the hobby.

Fractional ownership is absolutely the next frontier, and its just getting started. With rising prices across the board, many participants are getting priced out. Collectable provides an opportunity to own iconic assets in an affordable, liquid way. In addition, many are beginning to feel more comfortable owning items digitally instead of physically.

One key misconception of fractional is that it’s a substitute for physical collecting. This couldn’t be further from the truth. Fractional ownership is COMPLEMENTARY to physical collecting. The reality is that most of the items on Collectable are out of price range for all but a few collectors. We highly encourage people to physically collect what they love and what’s in their price range, and to invest and fractionally own assets they would not be able to afford otherwise.

Inside the Pack: One of my biggest concerns when fractional ownership began popping up, which I had written about on this blog about a year and a half ago, was the lack of the ability for investors to monetize their investment without finding another collector who wanted to purchase their shares. Moving forward, do you see the private buyout option becoming prevalent in the world of fractional ownership?

Ezra Levine: There are two primary ways investors can monetize their investment on Collectable: our secondary market and via buy-out offers. Eligible offerings will trade twice per week on our secondary market to start, with the goal to create a liquid 24/7 marketplace once the infrastructure around us matures a bit. We’ve also shown the prevalence of buyout offers on our platform already, many of which have come within a short period of time at very attractive returns. I expect both to become frequent sources of liquidity for investors on our platform – with liquidity improving over time as our user base and brand continues to grow and infrastructure expands.

Inside the Pack: The secondary market place launched on Friday, February 5. Tell us a little about how that works and what sort of value you see that adding to the Collectable space.

Ezra Levine: We’re excited to introduce a continuous, intraday trading feature to the collectibles space. Our plan is to “start small” then gradually expand this continuous trading feature across the full trading day. Crawl, then run. Here’s how it will work: bids and asks that have been submitted between trading windows will be matched and executed right at 3pm EST, should they be within market parameters. Then, the market will go continuous for the last hour of the trading day. We’re calling this “Power Hour.” Each eligible offering will trade twice per week to start. Ultimately our vision is to allow collectors to trade shares of Michael Jordan or Mickey Mantle just like they would trade shares of Amazon, Facebook, or Google.

Inside the Pack: Anything else to add?

Ezra Levine: Thanks so much to our community for their support since September. Our rock star team is working tirelessly to build the best possible product with the best possible supply for our users, and we’re not going to stop. We love the hobby, and are excited to bring liquidity, transparency, democracy, and continued innovation to the category as it becomes solidified as a viable alternative asset. We look forward to rolling out additional features and offerings for our users!